United States consumers collectively carry over $900 billion in credit card debt. For households carrying debt, that’s an average of nearly $16,000. When factoring in other debt like mortgages, auto and student loans, it’s scary to think the amount of debt many Americans live with.

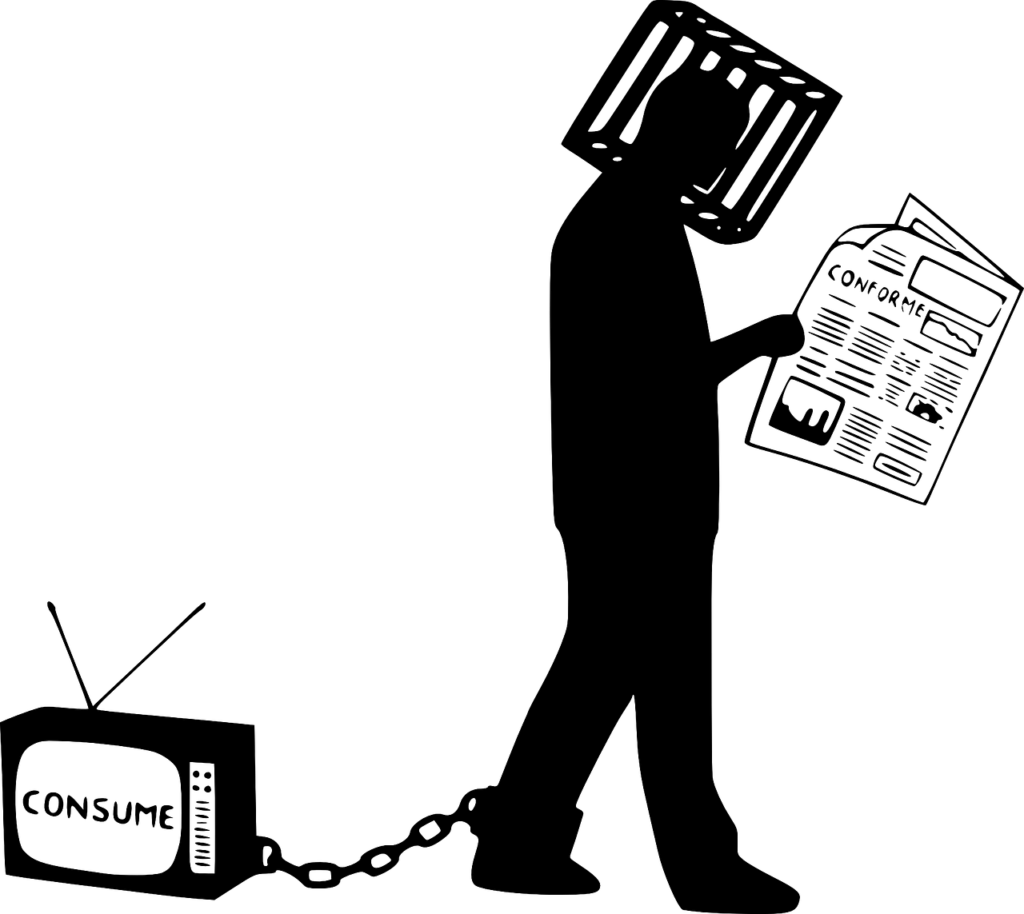

And while some debts are more necessary than others, there’s nothing logical about accumulating credit card debt with astronomical interest rates. At the core of this widespread financial plague is a behavior: compulsive overspending. In America, it’s merely become a way of life.

To get to firmer financial ground and be happier with our choices in the process, let’s look at how to combat the dreaded impulse of overspending.

Know Your Problem Areas

For many of us struggling with compulsive spending, we have specific areas we like to indulge in. Whether that’s shoes, tech gadgets, records, going out to eat, or something else, we’re humans and we fall into behavioral patterns. It’s the patterns and routine that kills us. There’s nothing wrong with buying a record, a new gadget, a lunchtime burrito or a pair of running shoes that we need. It’s quite another to buy a few pairs of shoes a week, buy lunch every day, or ten records a month. Even if your habit is a relatively small purchase, like a latte, it still adds up to major money if you indulge on the regular.

Write Things Down

Hand in hand with identifying your problem areas is writing things down. Since most of us these days exclusively use plastic, it’s even harder to feel the money leaving our account. The best way to combat this—even better than a budget, is to write purchases down. Every nickel spent should be itemized in a notebook. Keeping a digital budget is good too, but we’re often more removed when looking at things on a computer. When forced to write out each daily purchase made, and then look back at those purchases at months-end, it’s easier to realize how many things we could have gone without buying.

Hang Out with Financially Responsible People

Regardless how motivated you are to change, it’ll be next to impossible if you’re surrounding yourself with financially frivolous people. If you’re around people that exercise caution and restraint with their spending, it’ll rub off on you. As you see the contentment they get from their moderate spending, you’ll feel empowered to achieve the same for yourself.

Think of Those Affected By Your Compulsive Spending, Ask for Help

Like other types of addictions, an effective treatment is to think of those close to you and how they’re affected by your actions. Maybe you have a friend that you’re constantly shorting on the rent or maybe your significant other foots most of your bills. Perhaps your parents are still helping you out because most of your income is going to fleeting purchases. Whatever the case, think critically about whom you’re affecting and be communicative about your intent to improve the relationship and dependency.

Get Out of Debt

Your overspending has likely resulted in accumulated credit card debt, and there’s no better time to make a plan to get out of it than when you’re shifting your entire financial mindset. It’ll be difficult getting used to throwing money at a total that doesn’t seem to get any smaller, but once you get in the habit of making regular payments, your debt will slowly shrink and you’ll feel better about yourself. If you have multiple balances, prioritize paying the most on the one with the highest interest rate, and the minimum or whatever you can afford on the balances with lower interest rates. If your debt situation is out of your financial means, there’s also debt relief professionals that can help you choose a sensible strategy. Financial thought leader, Andrew Housser, who’s often quoted giving financial savings tips, runs one such company, but dozens exist, so call around and do you research.

Set a Budget You Can Stick To

Setting a budget probably goes without saying, but too many overspenders, like people suffering from other addictions, try to change their behavior cold turkey and relapse in the process. You need a budget because you need something to hold you accountable, but it doesn’t need to be so strict that you make failure inevitable. The goal here is to get you feeling good about where your money is going, not to simply adhere to rules you’ve drawn out.

Overspending makes us all feel bad once the rush wears off, so cultivating habits that allow us to get value from our spending is critical. Start your budget with your essential needs: rent, groceries, utilities, gas, insurance, contribution to an emergency fund, etc. After those essential life areas are taken care of, you can treat yourself a little with a little hobby or leisure spending. Spending money on yourself after you’ve paid all your necessary expenses (and yourself) should feel good. It should motivate you to continue making healthy financial strides.

It’s not easy beating any addiction. But by carefully analyzing your problem areas, methodically tracking your actions, surrounding yourself with positive influences, asking for help from loved ones and setting a spending foundation to build off, you can get there.